Sebuah tim dokter perempuan dari berbagai negara telah bekerja sama untuk membantu warga pedalaman Papua memahami pentingnya kesehatan dan merawat diri mereka dengan baik. Tim ini terdiri dari dokter-dokter muda yang berkomitmen untuk memberikan pelayanan kesehatan yang berkualitas kepada masyarakat yang membutuhkan.

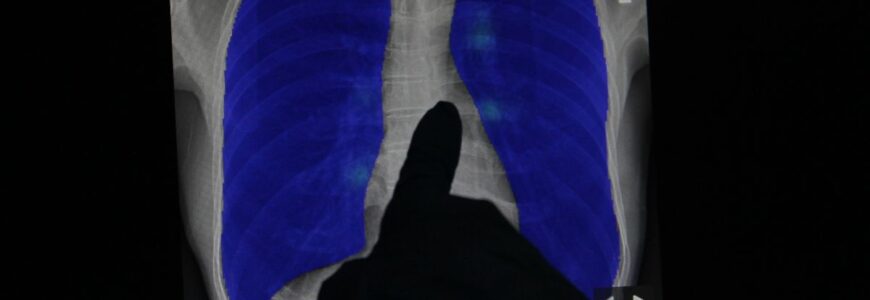

Papua merupakan salah satu daerah terpencil di Indonesia yang masih memiliki tingkat kesehatan yang rendah. Banyak warga yang tidak memiliki akses ke layanan kesehatan yang memadai, sehingga mereka seringkali mengalami masalah kesehatan yang serius. Oleh karena itu, kehadiran tim dokter perempuan ini diharapkan dapat memberikan edukasi dan pemahaman yang lebih baik tentang pentingnya menjaga kesehatan.

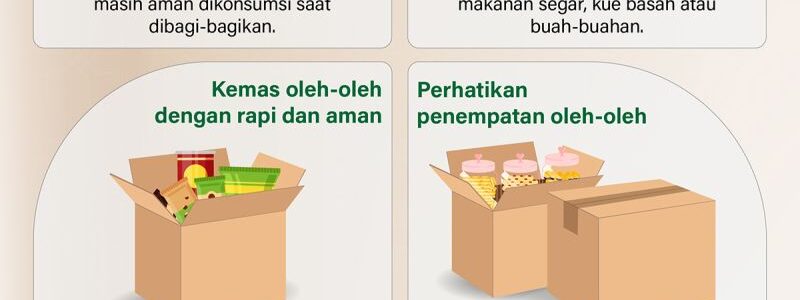

Selama beberapa bulan terakhir, tim dokter perempuan ini telah melakukan berbagai kegiatan seperti pemeriksaan kesehatan, penyuluhan tentang gaya hidup sehat, dan pembagian obat-obatan kepada warga pedalaman Papua. Mereka juga memberikan edukasi tentang pentingnya vaksinasi, perawatan gigi, dan pola makan yang sehat.

Dengan adanya kehadiran tim dokter perempuan ini, diharapkan warga pedalaman Papua dapat lebih memahami pentingnya kesehatan dan merawat diri mereka dengan baik. Selain itu, diharapkan juga bahwa mereka dapat menerapkan pengetahuan yang mereka dapatkan dari tim dokter perempuan ini dalam kehidupan sehari-hari mereka.

Kreator dokter perempuan ini adalah contoh nyata dari dedikasi dan komitmen untuk membantu masyarakat yang membutuhkan. Mereka telah memberikan kontribusi yang sangat berarti dalam meningkatkan kesehatan masyarakat Papua, dan semoga kehadiran mereka dapat terus memberikan manfaat yang besar bagi kesehatan masyarakat di daerah-daerah terpencil lainnya di Indonesia.